The dangers of Consent Judgments

Generally, a Georgia consent judgment is a judgment that can’t be collected on by wage or bank garnishments unless you are late on your payments.

Defaulting on a consent judgment can be devastating to your financial future!

It is important to understand the possible consequences of defaulting on a consent judgment.

If you must settle, try to work out a lump sum settlement for the dismissal of the lawsuit rather than the entry of a consent judgment.

It is always advantageous to make a one-time lump sum settlement payment versus a payment plan over time via consent judgment if you are in the financial position to do so. Debt collectors are often more likely to accept a smaller overall settlement amount if it is paid in one payment and within a short amount of time (for example, to be paid within 30 days). Also, a lump sum payment settlement agreement can be arranged where the lawsuit is dismissed with prejudice upon your payment of the lump sum settlement. The “with prejudice” part means the case cannot be brought against you again in the future. Anyone searching the court’s public records would simply see that the lawsuit against you was dismissed, instead of a judgment having been entered against you. If you aren’t able to do the lump sum payment option for a settlement of the lawsuit, the alternative is payments over time, which is typically done in the form of a consent judgment.

What are the consequences of a judgment in Georgia compared to a consent judgment?

In order to understand the significance of a consent judgment, let’s first talk about the consequences of a Georgia judgment in general. Generally, a judgment is the conclusion of a civil lawsuit where the court says who wins (winner = “judgment holder”) and for how much money. The judgment holder can then pursue collection actions to forcefully collect the money from the losing party (“debtor” or “defendant”). In Georgia, the judgment holder has different collection methods available to pursue payment of the judgment, including wage garnishment, bank account garnishment, and liens against your property.

The judgment holder can file a wage garnishment action where up to 25% of the debtor’s paycheck is automatically deducted and sent to the court and ultimately the judgment holder. A wage garnishment can be in place for up to six years or when the judgment is paid in full, whichever occurs first. The judgment holder could file a bank account garnishment on any bank account on which the debtor is listed as an owner. The bank account garnishment will freeze all the money contained in that bank account up to the amount of the judgment. Typically, you will have no prior notice that this is happening, and you may wake up to find your bank balance frozen.

Judgment holders can also file a document called a Writ of Fieri Facias (“Fi.Fa.”) Once the judgment holder obtains their judgment, they can request that the court issue them a FiFa. The FiFa can be used to attempt different types of judgment collection methods, but for this post, I am limiting the discussion to liens against your home. The FiFa document is recorded on the “general execution docket” maintained by the Clerk of Superior Court in the Georgia county where you have any property located. If you are a homeowner with a legally enforceable FiFa recorded against your property, you can be forced to pay the judgment holder as part of any attempt to refinance or sell your house. Whether you are a homeowner or not, the judgment holder may record a FiFa anyway for the purposes of renewing the judgment in the future.

Georgia judgments are renewable and, if properly renewed, can last forever!

What’s the difference between a consent judgment and a judgment?

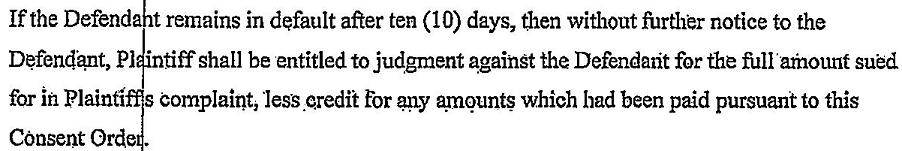

Once a debt collector has filed a lawsuit, any agreement of settlement that includes payments over a period of time will very likely require you to sign a consent judgment. Generally, a consent judgment is a judgment that is not enforceable by wage or bank account garnishment unless you miss a payment or make any late payment. The judgment holder may file a FiFa as part of the consent judgment if it elects to do so in the language of the agreement. Other debt collectors may file a FiFa only if you default on your payment obligations. The main difference between a regular judgment described above and a consent judgment is that you are agreeing to have the judgment entered against you and you are agreeing to make payments toward it. In return for your agreement for payments, the debt collector agrees not to take collection actions such as garnishment unless you default on your payment obligations. Depending on the language in the consent judgment, the debt collector may be entitled to forcefully collect the judgment against you as described above If you are late in making any of your payments.

Can you negotiate the terms of the consent judgment? Sometimes, yes!

Typically, the debt collector already has a form it uses for its consent judgments and they are not always up for debate. However, these forms and willingness to negotiate on its terms vary amongst different debt collectors so it certainly doesn’t hurt to ask. There are several aspects of a consent judgment that might be negotiable.

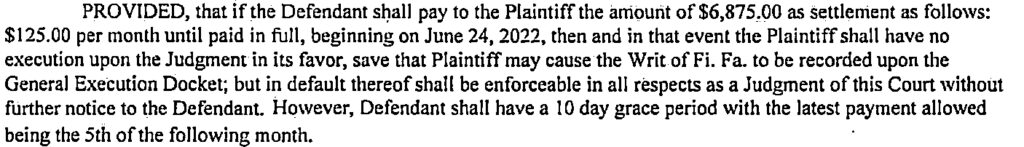

Overall Settlement Amount: Some debt collectors will negotiate with you and the final consent judgment may be an agreement that you will pay some amount less than what the debt collector is seeking in the lawsuit. Some debt collectors will refuse to agree to a consent judgment for anything less than the full amount sought in the lawsuit However, if you are even considering signing a consent judgment, it does not hurt to propose to agree to pay an overall settlement amount that is less than the full amount sought in the lawsuit. However, keep in mind that consent judgments that allow for you to pay a settlement amount less than the lawsuit amount may also say that if you are late on your payments, even one time, the overall amount due is no longer the agreed lesser settlement amount. Instead, it may increase back up to the amount of the lawsuit minus any payments you already made. In this case, being late on a payment will undo any benefit you obtained in negotiating a lesser settlement amount.

Payment amounts over a longer period of time. One benefit to a consent judgment is that it might allow you to make payments over an extended period of time to reduce the overall monthly payment. The period of time allowable for payment of the settlement amount varies amongst debt collectors but can often be negotiated. The period of time could be a few months of payments or several years of payments. Depending on the overall settlement total, the debt collector may have its own preset payment periods that it is willing to accept. I have seen some larger balance consent judgments settle for payments over a seven-year period. Keep in mind, the longer the payment arrangement, the higher the likelihood of default.

Late payment grace period. Some consent judgments will provide a grace period in which the defendant may make a late payment without being considered to be in default of the consent judgment. This is a very beneficial safety net to avoid defaulting on a consent judgment.

Filing of a FiFa. Many consent judgment agreements provide that the judgment holder has the right to file the FiFa lien against your property as part of the consent judgment whether you are late in payment or not.

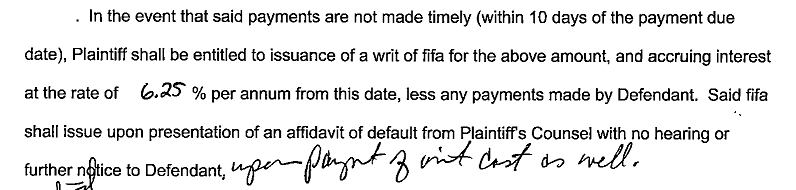

Notice of default. Many consent judgment agreements do not provide that any notice be given to the defendant in the event of default. In other words, once you are late on a payment, they can move forward with forcefully collecting the judgment against you without giving you a heads-up. This is why it is extremely important to document every single payment you make toward a consent judgment so you have a paper trail showing you have complied with all aspects of the agreement.

Post-judgment interest. Some consent judgment agreements provide that the judgment holder waives its entitlement to post-judgment interest. Others provide that post-judgment interest may start accruing on the unpaid balance only if you default on the agreement. It is important to understand that the legal rate of post-judgment interest in Georgia is tied to the federal prime rate and the prime rate has increased in the past year. It is always more beneficial to you if the consent judgment agreement agrees to waive post-judgment interest altogether. If you default on the agreement, it can make it difficult to determine exactly what you owe on the judgment especially if it is accruing post-judgment interest on a daily basis. It’s better to know exactly what you owe on the judgment balance rather than it accruing interest on a daily basis.

You may have other options.

A consent judgment may not be your best option!

When facing a debt collection lawsuit, you may feel pressured to sign the proposed consent judgment to get the looming lawsuit off your back. Before you sign any agreements with a debt collector, schedule a free case consultation with me. You may have options other than settlement.

Contact Me Now