Georgia Judgments Accrue Interest Over Time

What is post-judgment interest?

In Georgia, post-judgment interest is the rate of interest that accrues on a judgment starting from the date the judgment was entered and continuing until the judgment is “satisfied” or paid off. Since judgments in Georgia are renewable and can last indefinitely, post-judgment interest can continue to grow over time and the overall balance of the judgment can be much bigger than it was at the time the judgment was entered. Post-judgment interest automatically applies to judgments, even if the final order of judgment signed by the court says nothing about post-judgment interest.

Why should you care about the post-judgment interest rate?

If you are a consumer and you have a judgment entered against you, you should generally be aware that post-judgment interest is likely accruing on the principal part of your judgment balance. I say likely only because some judgment holders enforce post-judgment interest when they collect on a judgment and some do not. Nonetheless, they are entitled to it by law. The longer the judgment goes unpaid, the more the post-judgment interest will accrue and the bigger the ultimate balance will be. If the judgment is accruing interest, the rate of interest is either the rate of interest specified in the contract (if the case was based upon a contract) or the “legal rate” or “statutory rate”. Ultimately, post-judgment interest can mean that the amount of the judgment can increase greatly over time, especially if the judgment is renewed. If the rate of interest is the legal rate or statutory rate, this interest rate is tied to the federal prime rate. The federal prime rate has increased over the past year and so has the resulting legal rate of interest on judgments in Georgia.

Below is the text of the Georgia law on post-judgment interest which is found in the Official Code of Georgia Annotated (“O.C.G.A.”) and may be viewed here. For reader convenience, I have bolded certain important phrases of the law and included a link to the Federal Reserve System’s H. 15 release page.

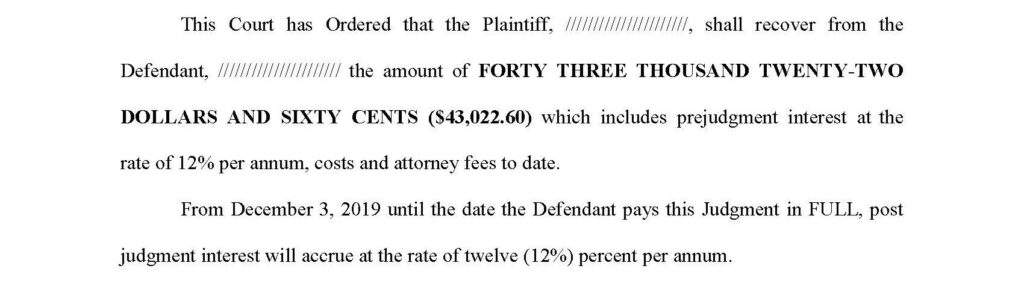

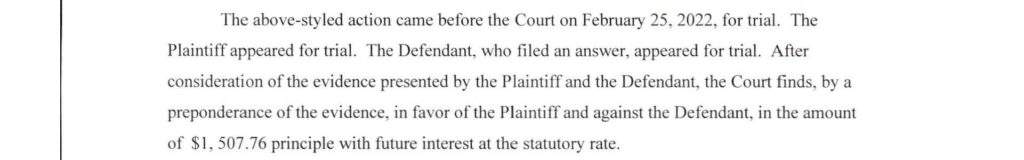

O.C.G.A. § 7-4-12. Interest on judgments (a) All judgments in this state shall bear annual interest upon the principal amount recovered at a rate equal to the prime rate as published by the Board of Governors of the Federal Reserve System, as published in statistical release H. 15 or any publication that may supersede it, on the day the judgment is entered plus 3 percent. (b) If the judgment is rendered on a written contract or obligation providing for interest at a specified rate, the judgment shall bear interest at the rate specified in the contract or obligation. (c) The postjudgment interest provided for in this Code section shall apply automatically to all judgments in this state and the interest shall be collectable as a part of each judgment whether or not the judgment specifically reflects the entitlement to postjudgment interest. (d) This Code section shall apply to all civil actions filed on or after July 1, 2003.

How much is the post-judgment interest in Georgia?

The applicable post-judgment interest rate is either (1) the specific interest rate agreed to in the contract between the parties or (2) the “legal rate”. If the lawsuit upon which the judgment was issued was a case about a contract between the parties and that contract specifies an interest rate, then that may be the post-judgment interest rate that would apply. If the lawsuit between the parties is not based upon a contract or doesn’t specify an interest rate, then the “legal rate” will apply which varies.

Judgment interest does not accumulate on interest, only the principal amount.

Post-judgment interest only applies to the principal part of the judgment and does not compound (interest on interest). In other words, it does not accrue on parts of the judgment that are pre-judgment interest. See O.C.G.A. § 9-12-10. “No part of the judgment shall bear interest except the principal which is due on the original debt.”

Avoid a judgment in the first place!

If you are being sued by a debt collector, it is important that you take action to avoid a default judgment being entered against you. I offer free case evaluations.

Contact Me Now