Midland Credit Management, the biggest debt buyer in the U.S.

Through its parent corporation, Midland Funding / Midland Credit Management is the biggest debt buyer in the United States and the biggest lawsuit filer of the debt buyers in Georgia!

If you are interested in hearing more about my personal experience of being sued by a debt buyer, Check out my interview with WSBTV Channel 2 news.

Dear Midland,

You hold a very special place in my heart! Thank you for suing me many years ago and leading me to realize I should be become a lawyer and fight debt-collection lawsuits on behalf of consumers.

XOXO Jillian Sandt, Attorney at Law

Company Background

To understand how the debt buying process works, see my article, What is a Debt Buyer?

Midland Funding and Midland Credit Management are debt buyer companies that file lawsuits against consumers. They pay pennies on the dollar for these debts and sue consumers for the full amount of the debt. Midland Funding LLC and Midland Credit Management, Inc. are legal entities used as a “vehicle” to sue consumers across the United States. Midland’s parent company, Encore Capital Group, Inc., is a publicly-traded company based out of California. Encore Capital Group, Inc. and its subsidiaries (including Midland Funding, LLC, Midland Credit Management, and Asset Acceptance Capital Corp.) are the nation’s largest debt buyer and collector. The “servicer” of the debt is Midland Credit Management (Kansas) and it is often this legal entity from which you will see credit reporting entries, collection letters, and lawsuit affidavits. Other legal entities associated with Midland include Midland Funding NCC-2 Corporation (Delaware), Midland Portfolio Services, Inc (Delaware), MRC Receivables Corporation (Delaware), and Atlantic Credit & Finance. Because Encore uses its “Midland” entities to interact with consumers, this post refers to Midland and Midland Funding generally to refer to the corporate family.

How does Midland get people to pay?

Midland uses the usual debt collector tools to get people to pay them: letters, phone calls, and lawsuits. If you are confused about why a company you may have never heard of

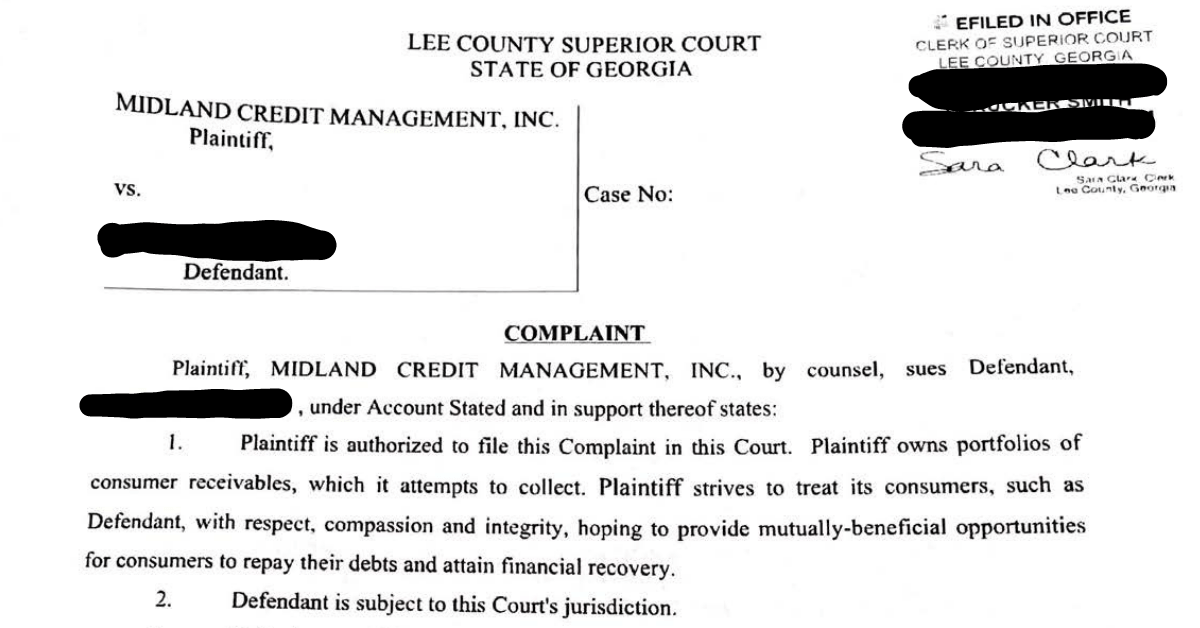

Midland Lawsuits in Georgia

Between 2020 and April 2023, Midland Credit Management and Midland Funding filed more than 20,000 new lawsuits against consumers in Georgia!

The majority of people who are sued by debt collectors and served with the lawsuit do not file an answer! They end up getting a default judgment against them and face bank account garnishments, wage garnishments, and liens on their property. Judgments in Georgia have the potential to last forever and can accrue interest over time. Now is not the time to stick your head in the sand if you are being sued. Nor is it the time for you to just roll over and do whatever the debt collectors want you to do. The decisions you make now can affect your financial future for many years to come. Before you take any action, give me a call at (770) 714-1404 or send me a message through this website (see form below) and schedule a free 30-minute telephone case consultation.

Midland files some of its lawsuits in Georgia itself through its own in-house attorneys. However, the majority of the lawsuits filed on behalf of Midland in Georgia are filed by debt collection law firm Aldridge Pite & Haan. Other debt collection law firms filing lawsuits in Georgia for Midland are Law Office of Emmett L. Goodman, Jr. and Cooling & Winter LLC. Midland files lawsuits alleging that it purchases debts from lenders, banks, other debts buyers, and other institutions such as:

- Capital One Bank

- Credit One Bank (Many accounts purchased from Sherman, an LVNV Funding debt buyer affiliate)

- Comenity Bank

- Citibank

- Synchrony Bank

- Fifth Third Bank

- Department Stores National Bank

- Bank of Missouri

- WebBank

- and others!

Midland buys Charged Off Debt at Pennies on the Dollar ($0.13 in 2018) and Collects the Total Amount of the Debt from You.

During 2018, the Midland family bought portfolios of debt (mostly charged off credit cards) valued at $8.5

Consider this example to understand what purchasing for pennies on the dollar means: You owe your credit card company $1,000 on a credit card debt. You stop paying and the debt gets charged off. The credit card company sells that credit card debt worth $1,000 to a debt buyer like Midland Funding for $130 (13%). The debt buyer then goes after you for the $1,000. If the debt buyer is successful in collecting the full $1,000 from you, it made $870 in profit (minus expenses).

That’s a pretty good return on investment. Of course, the debt buyer won’t always be able to collect the full amount or any amount at all.

I have handled numerous Mindland cases. You don’t have to go through this alone. You have affordable options. Contact me to schedule a free consultation.