Crown Asset Management

Who is Crown Asset Management?

Crown Asset Management was founded in 2004 by Brian K. Williams. Its address is 3100 Breckinridge Boulevard, Suite 725, Duluth, Georgia 30096. According to its website, Crown has purchased over five hundred portfolios (each presumably including thousands of debts), including portfolios originated as credit card accounts, automobile loans, consumer loans, marketplace lending, judgments, and other types of specialty portfolios.

To understand how the debt buying process works, see my post, What is a Debt Buyer?

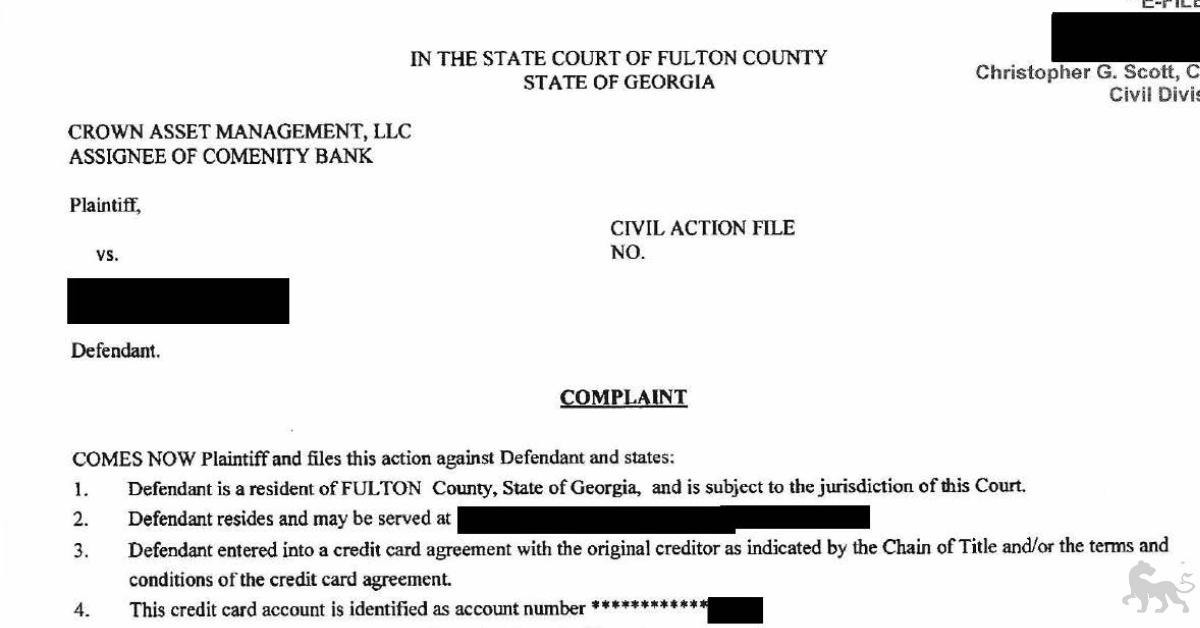

Crown Asset Management Lawsuits in Georgia

Crown Asset Management has filed more than 4,000 lawsuits against Georgia consumers since 2019. Overall, Crown Asset is not filing lawsuits in Georgia on the scale of debt-buying giants, Midland, LVNV Funding, and Portfolio Recovery Associates, but they might be in the top five. It doesn’t collect on its own debt – it utilizes other debt collectors and debt collection law firms to collect its debt. Another debt buyer, Second Round, also services some of Crown’s accounts. In Georgia, Crown files lawsuits against consumers through debt collection law firms Ragan & Ragan, PC, Hayt Hayt & Landau, and Rausch Sturm.

Crown files lawsuits on debts that it allegedly purchases from banks, lenders, and other institutions such as:

- Bank of Missouri

- Barclays Bank

- Celtic Bank

- Citibank

- Comenity Bank

- Comenity Capital Bank

- Dell Financial Services, LLC

- Department Stores National Bank

- First Electronic Bank

- First Investors Financial Services

- First National Bank of Omaha

- Genesis FS Card Services

- Great American Finance

- Prosper Funding

- Santander Consumer USA Inc

- Synchrony Bank

- WebBank