Don’t panic but you’re being sued by a debt collector.

When you find out you are being sued by a debt collector, don’t panic. Make a game plan to deal with the lawsuit so it doesn’t ruin your financial future.

Finding out you are being sued by anyone, especially a debt collector, is a stressful and scary situation. I know, I’ve been there. Keep in mind that the steps you take in response to the lawsuit may dictate your financial future for many years to come. Although financial times might be difficult for you right now, they may not always be this way. If you do nothing in response to the debt collection lawsuit, you may be facing a default judgment that will be hanging over your head down the road when your financial situation starts looking better. Don’t forget, in Georgia judgments are renewable and can last indefinitely! In addition, Georgia judgments accumulate post-judgment interest, meaning the balance of the judgment can grow over time. When you get back on your feet, the last thing you want is for your wages or bank account to be garnished or to have a judgment prevent you from getting your new home. Deal with it now and move on with your life.

DON’T PANIC AND ACT OUT OF DESPERATION!

Contemplate your options and don’t do anything out of panic. Sometimes, people panic when they learn about a debt collection lawsuit (sometimes through legal advertisements in the mail) or when are served with a debt collection lawsuit. The initial instinct is to make the lawsuit go away as fast as possible. They call the debt collector and attempt to strike a settlement to avoid going to court. Simply calling the debt collector to discuss possible settlement arrangements does not alleviate your responsibilities as a defendant to file a timely Answer with the court and show up for court when you are directed if you want to avoid a default judgment against you. Nothing you do will change the fact that a lawsuit has been filed against you. The matter is public record. You are better served by contemplating your options and developing a plan. Making decisions out of desperation may cost you a lot of money and headache down the road.

AVOID A CONSENT JUDGMENT IF YOU CAN

Obviously, you are not in a powerful negotiating position at the point in which you have been served with a debt collection lawsuit. The debt collector knows you are calling because you learned about the lawsuit or were served with the lawsuit and you are desperate. If a debt collection lawsuit has been filed against you, the debt collector will likely encourage you to quickly sign a consent judgment to settle the debt. Signing a consent judgment may not be your best option. In fact, there are serious consequences that can affect your financial future for years to come if you default on a consent judgment. Read in-depth about the potential consequences of a consent judgment here.

MAKE A PLAN

Generally, when you are served with a debt collection lawsuit in Georgia, you have thirty days to file your response to the lawsuit (an “Answer”) with the clerk of court. Determine the exact date you were served and mark it on the calendar. Then count out thirty days from there and mark that date on the calendar. (If the 30th day is a weekend or holiday, go to the next business day). Before that 30th day arrives, you need to have a plan for what you are going to do. If you care about your financial future, your plan will not be to simply ignore the lawsuit.

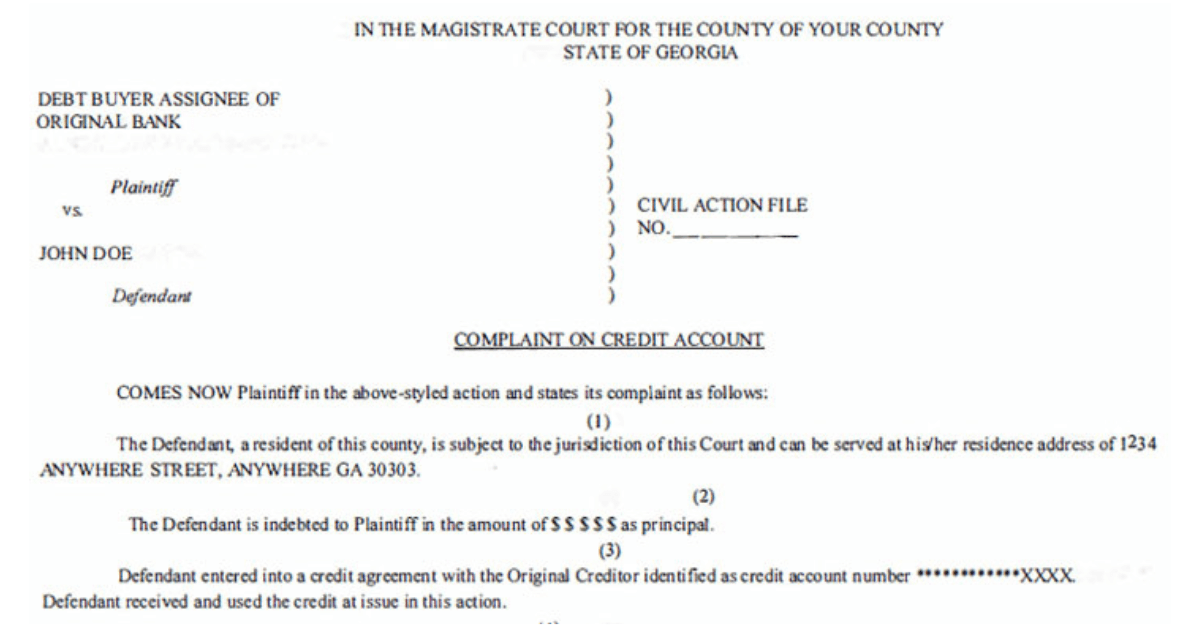

IDENTIFY THE DEBT

Determine whether you can identify the debt for which you are being sued. The lawsuit likely has very little information about the debt attached to it, but it may be enough to match it up with other documentation you may have. Do you have any statements from the original creditors that may show an account balance or account number? Have you pulled your free credit report lately to see what accounts are listed there? Did you keep any collection letters to help track where this debt came from? Even if you recognize the debt as being yours, this does not mean you don’t have potential defenses available to you in the lawsuit, especially if a debt buyer is suing you for the debt.

Even if you don’t think the debt is yours, take the lawsuit seriously.

If you are served with a debt collection lawsuit and the debt belongs to someone else, you must assert that defense to the lawsuit or you will get a judgment against you. I once had an individual call me to discuss a judgment that had been issued against you. He had a very common name (think “Jason Smith or “Robert Jones”) and he was served with a debt collection lawsuit for a debt that did not belong to him. It belonged to someone else who had the same name. He figured that since it wasn’t his debt, they couldn’t get a judgment against him. He didn’t do anything in response to the lawsuit. By the time he was calling me it was because his bank account had been garnished by the debt collector. They had secured a default judgment against him because he didn’t file an answer to the lawsuit. If he had dealt with the issue from the start, it could have been resolved. Instead, he ended up learning an expensive lesson the hard way. Even if you don’t think the debt is yours, take the lawsuit seriously because it can negatively affect your financial future.

Get a free case evaluation.

I offer free case evaluations by telephone for debt-collection lawsuits. I have handled hundreds of debt collection lawsuits across Georgia. Let’s talk through your options.